Dear Friends,

Welcome to 2025 and Happy New Year to everyone in the 3TS network! We are starting the year with a sense of optimism for an improving growth, investment and exit environment, despite major ongoing global challenges around us. After more than two years of expectations re-setting following the 2020-2021 exuberance, 2025 seems to be set up to be a year of increasing Tech budgets from enterprise customers, revived M&A activity (plus IPO window possibly re-opening) and a defining year where the new AI-driven innovation wave can begin to show tangible results. At 3TS, following a busy 2024 with 4 exits and 7 financing rounds, we kicked of 2025 with a record of 3 exciting new investments in Q1 (details below) and more on the way. Here’s to a fantastic, healthy, and peaceful 2025!

Cheers,

The 3TS Team

3TS Key Learnings

3 Key Learnings for Navigating 2025

A Slow But Steady Recovery Continues – Grow Carefully

The slowdown in 2022-2023 showed that the Tech buying spree in the prior couple of years was an aberration, not a new baseline. Afterwards, median revenue growth in software declined from 30% to 15% (or less) quickly, across most software sectors. In 2024, growth rates stabilized leveling off at 12-15% over past four quarters and revenue renewal rates are holding around 100%. Meanwhile, the sentiment from enterprise clients large and small begun to improve. Now, Gartner forecasts worldwide IT spending to grow 9.8% in 2025, with Software increasing 14% (versus 12% in 2024). That’s a lot of growth for any market. AI is an accelerant, but enterprise and corporate client priorities remain limited to 3-5 key areas. 51% of corporate buyers expect budget scrutiny to go up, and 2% expect it to go down. Much of the new spend falls into limited top categories: GenAI, Security, Analytics, Data infrastructure, and a few functional applications. Either your company is in one of those priorities, or it’s not.

PE/VC Funding is Stabilizing But Its Fragile – Have 18-24 Month Cash Runway

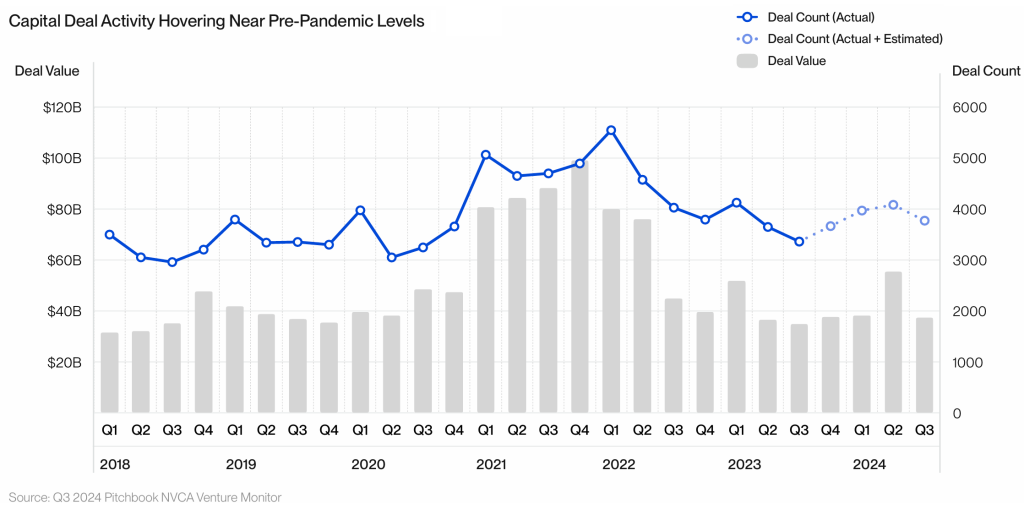

It’s too early to call it a comeback. Investor activity in terms of deal volume and capital deployed is holding steady over the past four quarters, returning to 2019 levels. But the bar for closing new rounds is high, focused on only the fastest growing, strongest market leaders, and the terms continue to be slightly investor friendly.

Valuations have increased in 2024 by 25% to 50% across Series A – D compared to the 2022-2023 period, but that is inflated by AI and only reflects those best-in-class companies that actually raised new rounds. Flat and down rounds are 28% of the total, which is a decade long high. Valuation increases between rounds were 1.2x in 2024 compared to 1.8-2x in prior periods. The growth capital market is still digesting the 2021 hype curve. On the other hand, funds at all stages have enormous levels of dry powder, 49% more than in 2019, which will need to be invested, however, more slowly and more judiciously.

M&A Market Set to Recover, But Unevenly – Always Be Exit-Ready

Previous M&A market down cycles saw a 50-60% decline in deal volume and valuations from peak to bottom over a two-year period, similar to 2021-2023. Followed by return to double digit increase, where 2024 was 11% above 2023. M&A activity is set to rise materially in 2025 as large incumbents, stronger companies and PE backers look for ways to increase market opportunity by adding adjacent products to their current solutions – remains to be seen if this pans out. M&A valuations are holding steady in the 4-6x revenue multiple range, which is below the long-term median of 6-8x – there’s an opportunity for 20-30% positive surprise. Growth is still the most dominant factor in valuations, even with Rule of 40, as faster-growing companies trade 35-75% higher, depending on the sector. Being exit-ready means reaching the right metrics consistently but also having your house in order to pass through tougher due diligence processes.

Looking forward, there’s isn’t a rapid recovery and it isn’t broad based, even though the market may be turning the corner. Watch you speed, your expenses and your runway. 2025 is setting up to be another year of efficient growth, with some upside to accelerate and reach higher exit valuations. Exciting times ahead!

3TS PORTFOLIO & NETWORK NEWS

3TS Fund IV Leads Wealthon’s €7m Round to Scale FinTech Ops for SMBs

Wealthon’s unique end-to-end platform seamlessly combines point of sale, scheduling, payments, loyalty, lending and other solutions in a single easy to use suite, which significantly streamlines and simplifies merchant operations. 3TS co-invested alongside a group of early-stage investors. Following the round, Wealthon also secured a PLN 500m (€116m) debt financing facility from Fortress Investment Group. Wealthon revenues doubled in 2024, and we are very excited to support the next stage of their growth!

MAVOCO Closes €11m Series-A+ Funding to Accelerate Global Growth

Mavoco’s Connectivity Management Platform (CMP) is a first of its kind carrier-grade solution enabling telecom operators and other providers to offer a complete set of IoT services that connect millions of industrial devices in automated and simplified ways. The investment round was led by 3TS Capital Partners, red-stars.com, and additional investors. The funds will be used to fuel further growth of MAVOCO’s next generation IoT CMP for the global telecom sector.

.lumen Raises €5m led by Catalyst Romania to Reinvent Mobility for the Visually Impaired.lumen’s breakthrough AI-driven eyewear can truly revolutionize autonomous pedestrian navigation for millions of visually impaired around the world. 3TS’ sister fund Catalyst Romania is proud to join .lumen’s mission by co-investing alongside European Innovation Council (EIC) Fund, Tigrim Capital and SeedBlink.

GOOD READS & GREAT IDEAS

How AI Impacts the SaaS Buyer Landscape,by SaaStr and G2

52% of companies are planning to buy more software in 2025, driven in part by the push to adopt AI. That’s the good news! But knowing buyer behavior is a must and it’s changing – client focus on clear value proposition not hype and much more rapid time-to-value (i.e. 90 days or less). Here’s The Buyer Behavior Report from G2 as input for your marketing and sales teams.

30 Best Pieces of Company Building Advice from 2024,by FirstRound Review.

Actionable summary of time-tested company building insights that every CEO should adopt, from staying on top of an upended plan, to putting earmuffs of your “happy ears”, to avoiding the “shiny object” syndrome, to adding great rigor to customer reference calls, and getting marketing idea from outside your segment.

The Price of Your Product is Wrong,by Kyle Polar

We see this way too often. Here are 5 pricing mistakes to absolutely avoid starting now in January 2025: don’t stay underpriced for too long; find the right value-metric that customers agree with; find the land & expand pricing vectors; avoid static pricing, it prevents expansion. And related to this topic, see 50 SaaS Pricing Pages to See How Pricing/Subscriptions are Structured and How to Create an Effective Pricing Page.

JOIN US AT THESE EVENTS

0100 Conference DACH 2025 – 18 – 20 February 2025, Vienna, Austria

Investors’ Forum 2025 – 19 – 20 March 2025, Geneva, Switzerland

AGC Partners’ 2025 European Software Summit – 21 March 2025, London, England

GPC Conference – 7 – 9 April 2025, New York City, USA