Last month, 3TS portfolio company ConveyIQ announced its new financing round where it raised $5.5m to accelerate growth of its talent communications platform. Congrats to ConveyIQ and their entire team! The new round was led by SC Ventures. 3TS and Starvest Partners, along with other current investors also participated. The capital will help drive ConveyIQ’s leadership position in the enterprise talent communication and recruiting automation space by fueling sales, marketing, new product expansion and channel partnerships. Over 140 enterprises, including NBC Universal, Deloitte, Warby-Parker, WeWork, OceanSpray, and Convergys, leverage ConveyIQ to automate recruitment processes. Customers have achieved dramatically improved candidate engagement, speed to hire and talent quality, while optimizing their large and growing investments in candidate sourcing. ConveyIQ has tripled in size over the past three years and continues its growth trajectory into 2019. To learn more how ConveyIQ helps enterprises in their talent communication needs, please see a detailed case study here.

Allison Munro Joins Piano Software as Chief Marketing Officer

Earlier this month Piano Software announced that Allison Munro has joined the team as Chief Marketing Officer. This is a new position for the company, as Piano continues to expand its worldwide business. In her role, Munro will align the marketing and sales organizations around the company’s go-to-market strategy and growth opportunity. She will also oversee Piano’s brand and reputation in the market. Allison joins Piano from Viafoura, a provider of audience engagement tools specifically built for news publishers and media companies, where she was the Head of Marketing and Sales. Prior to her tenure at Viafoura, Allison developed and led high-performance marketing teams at Oracle Marketing Cloud, NexJ Systems and Broadstreet Data, through crucial stages and rapid growth. We wish Allison all the best at her new position at Piano!

DVN CEO Summit Recap

Earlier this month, 3TS was one of the key participants at the 0100 Venture Capital and Private Equity conference that was held in Prague. The one day event brought international and regional LPs and GPs together where they exchanged perspectives and shared insights about the industry and trends. The conference was attended by more than 250 industry professionals and the program featured more than 50 speakers on multiple panels covering topics such as buyout trends in the region, fundraising climate for GPs and value creation best practices. 3TS Managing Partner Pekka Maki was one of the speakers on the panel discussion focusing on exits and he shared his views about recent exits and future outlook for technology company transactions in the region.

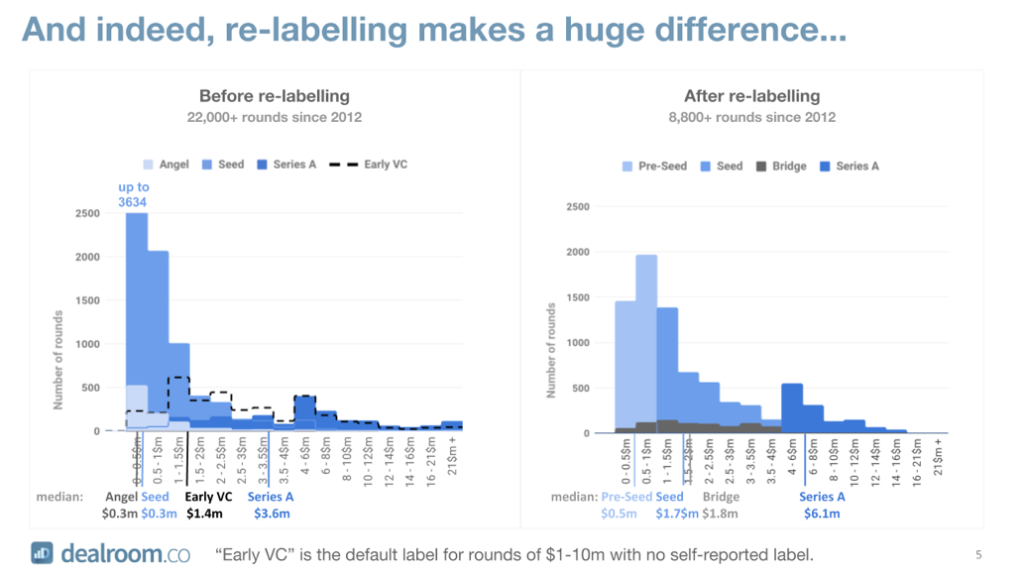

- European early stage funding has continuously increased, now at 4x relative to levels in 2012.

- The median time from seed to Series A is around 18 months

- While the average conversion rate from Seed to Series A is 19% within 36 months from the Seed round.

- Companies raising €2-3m in total pre Series A funding convert better than those raising less but raising more than €3m does not improve success rates.

- And there is a growing share of Series A in the range of €7-15m

- You can click here to read the full report or visit www.dealroom.co