Dear Friends,

While summer is upon us, investors and companies will have to continue to navigate through ‘storm clouds and rough waters’ for at least the next few quarters, or longer. Through the challenging first half of 2022, it’s exhilarating to see how 3TS portfolio companies and their teams continue to accelerate growth, establish leadership positions in their sectors and deliver tremendous value for their clients. Take a look at our portfolio company headlines below. We hope you all have a chance to unwind a bit this summer, in order to re-gain energy and march-on.

All the best,

The 3TS Team

3TS KEY LEARNINGS

The 3TS team had the opportunity to spend a week in Berlin with 4,000 other investors, managers and service providers, at what proved to be the largest SuperReturn event in history. The general sentiment was one of cautious optimism, with macro disruptions creating opportunities in the lower and mid private equity markets in terms of re-adjusted valuations, consolidation plays and finding new profitable niches for growth.

Key takeaways:

- This period will most likely be a prolonged stagnation rather than a steep recession, largely driven by central bank monetary retrenchment and commodity driven inflation. Prepare for enterprises of all sizes and consumers to slow down their spending.

- The hardest hit sectors will be the brick and mortar capital intensive supply chain dependent ones, while the most protected will be the digital economy enablers and the energy transition players. So pick the vertical industries you sell into very carefully.

- While the tech sell-off was front page in many discussions, investors are still keen to deploy capital towards tech innovation especially in late stage companies with proven management and stable operations. The flight to quality is set to continue.

- The general consensus was that European valuations started off from a lower point than their US counterparts, so the downward adjustments should be less drastic. It’s more important to have the funding necessary to grow than the relative dilution.

Overall, capital continues to be raised, deal activity has slowed down but is expected to pick up towards the end of the year. At 3TS, we are excited to continue our growth capital investment strategy, which has been proven to be well suited across all types of market environments.

3TS PORTFOLIO & NETWORK NEWS

Erste Asset Management Launches First Private Equity Fund of Funds

Congratulation to Erste Asset Management on this important step of launching their first fund-of-funds! We are proud to partner with Erste as an LP investor in our new 3TS Fund IV and look forward to many successful investments together.

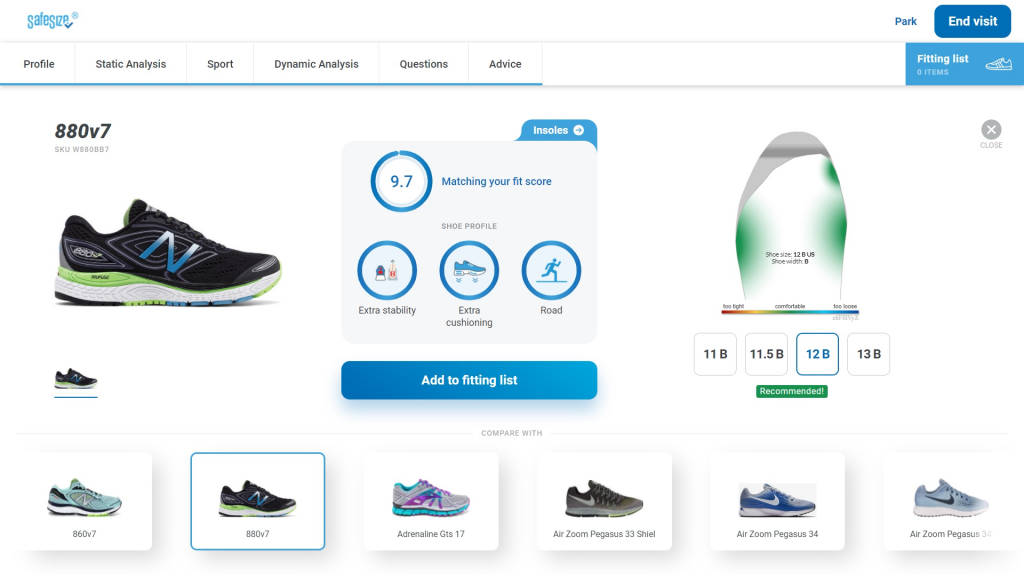

Safesize Supports Xebio Co. in Optimizing the Customer Experience

Japan is known for forward thinking design and innovation. So it’s no surprise that Xebio, one of the largest footwear retailers with over 800 stores, deployed SafeSize’s breakthrough footwear personalization & recommendation solutions to amp-up customer engagement, conversion rates and revenue.

Perfect Gym Named Finalist in the 2022 Fit Summit Awards

We are thrilled to see Perfect Gym recognized as a software product leader across the health, fitness, wellness and hospitality verticals. Congrats to the team, and you’re in great company alongside Mindbody, ClassPass, Ezpay and many others.

Hunch Raises €4m led by Catalyst Romania Fund II

We welcome Hunch into the 3TS family! Our sister fund, Catalyst Romania Fund II, led the round in this fast-growing, market leading dynamic creative automation platform. Proven to increase engagement, conversion to revenue and lifetime value with the right ad creatives, at the right time, Hunch empowers global consumer facing corporations and their agencies to dominate social commerce.

GOOD READS & GREAT IDEAS

SaaS Spending Is Going to Grow Even Faster Than We Expected in 2023 – by Gartner

It’s not all bad news out there. We are still in the early phases of SaaS and Cloud Computingadoption. Enterprise software spending globally was $529B in 2020 and in 2023 it will be $750B. 42% growth in three years is a massive demand curve we can all take advantage of.

What the SaaS Collapse Means for Every Leader – By Nick Mehta, CEO Gainsight in Inc Magazine

No matter what you call it, a 40-50% downdraft in valuations combined with macro challenges, sets up a challenging period for the next couple of years. Here, the CEO of Gainsight, the leading customer success platform, offers some actionable, no-nonsense ideas how to navigate turbulent times.

How to Spot — and Develop — High-Potential Talent in Your Organization – by Harvard Business Review

The quest for top talent has gotten harder and much more expensive. Meanwhile, having a well-tuned promotion engine for high potential individuals is a proven way to build the leadership of tomorrow and create employee retention. HBR outlines a practical three-part approach that can help your organization identify and develop the next-generation.

JOIN US AT THESE EVENTS

CEE Deal Leaders’ Summit – 29 – 30 June – Vienna, AustriaEndeavor International Investor Roadshow – 13 – 15 July – Kallithea, Greece

Pirate Summit – 6 – 7 September – Cologne, Germany

IPEM 2022 – 20 – 21 September – Cannes, France